Dividends Explained: What You Need to Know (Without the Jargon)

We’re here to simplify one of the most common financial topics – dividends – in a way that actually makes sense. Whether you’re running your own business or just curious, let’s break it all down for you: What Are Dividends? Think of your business like a bakery. You work hard baking cakes, selling them, […]

HMRC Rule Changes for Double Cab Pickups: What You Need to Know

From 6th April 2025, significant changes are coming to the way double cab pickups are treated for VAT and tax purposes. These changes could impact both businesses and individuals who currently benefit from their classification as commercial vehicles. Here’s a breakdown of the new rules, what’s changing, and what it means for you. What’s […]

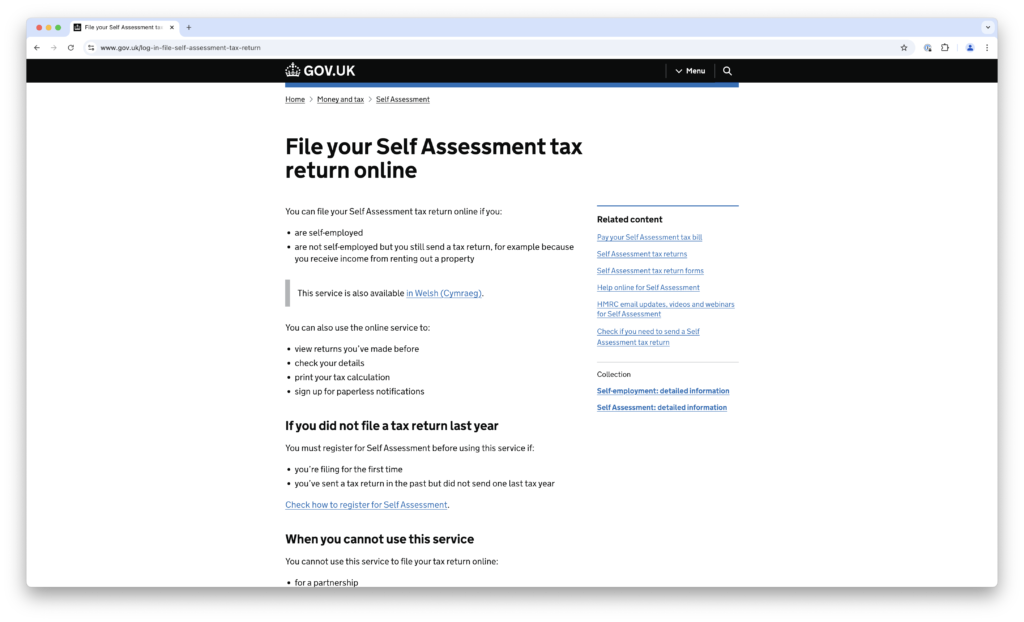

How to Register as Self-Employed with HMRC

Starting your own business or side hustle is an exciting journey! One of the first steps for any budding entrepreneur in the UK is registering as self-employed with HMRC. It might sound daunting, but it’s actually a straightforward process. To make it even easier, we’ve outlined the key steps and included a helpful video for […]

Understanding Allowable Expenses

Navigating the intricacies of the UK tax system can be a daunting task for individuals and businesses alike. However, understanding allowable expenses is fundamental to ensuring that you pay the right amount of tax and maximise your potential deductions. In this blog post, we will delve into what allowable expenses are, how they can help […]

Why You Should Hire an Accountant: Unlocking Your Financial Potential

In today’s fast-paced, ever-evolving business landscape, managing finances can feel like trying to navigate a maze without a map. Whether you’re a business owner, a freelancer, or managing personal finances, the complexities of accounting can be daunting. Many individuals and businesses wonder: “Do I really need to hire an accountant?” The short answer: Yes, and […]